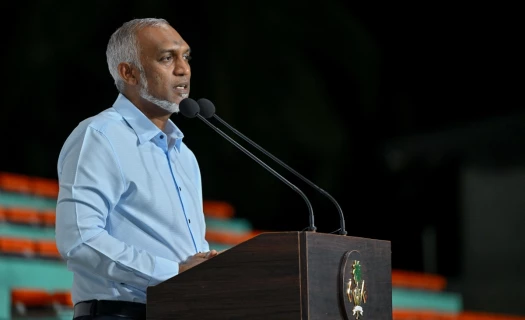

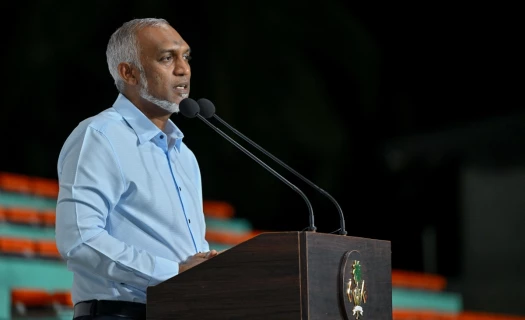

E-Wallet service launched: Fulfilling President's promise on foreign transfers

Bank of Maldives (BML) has launched new digital wallet services and foreign money transfer platforms in line with President Dr. Mohamed Muizzu's pledge.

The initiative aims to facilitate seamless international transactions for customers.

President Muizzu administration has committed to eliminating obstacles to online payments and cultivating an economy conducive to creative and technical industries.

Recently, the President reiterated plans to introduce e-wallet services by May, signaling the commencement of efforts in collaboration with the Bank of Maldives.

BML announced today that customers can now transfer funds to and from foreign merchants using their Visa USD credit cards or Mastercard prepaid USD cards.

Additionally, BML debit cardholders with a US dollar account can wire money to foreign accounts directly.

Karl Stumke, CEO of BML, highlighted that these enhancements are designed to support small businesses and freelance workers who rely on overseas funds for their livelihood.

He emphasized that these improvements are part of BML's commitment to enhancing customer banking and payment services.

Minister for Economic Development & Trade, Mohamed Saeed, echoed Stumke's sentiments, stating that facilitating dollar transactions for small businesses and freelancers is crucial for their success and economic progress in a post made on X.

Furthermore, the cabinet has decided to engage directly with the United States government to introduce PayPal services in the Maldives.

The President's agenda also includes plans to introduce Payoneer, Skrill, Stripe, and Neteller services alongside PayPal.

Minister of Homeland Security and Technology, Ali Ihusaan, recently reiterated the President's vision to introduce E-wallet services and explore opportunities to export this technology to other countries for the benefit of Maldivians.

Additionally, it is worth noting that there has been longstanding demand for E-wallet services among young citizens in the country.